Consumption of summer products like ice creams & beverages same or lesser for 79% consumers – as per Axis My India June CSI Survey.

Axis My India, a leading consumer data intelligence company, released its latest findings of the India Consumer Sentiment Index (CSI), a monthly analysis of consumer perception on a wide range of issues. The June report reveals intriguing insights into the changing spending patterns and consumer behavior in India. Notably, overall household spending has remained consistent, with a slight increase in Rural as compared to Urban markets. Furthermore, the survey shed light on consumer preferences for summer durable products like air conditioners (AC) and refrigerators and summer products such as ice creams and beverages, revealing a slightly muted summer. These findings provide valuable insights into the evolving market trends and consumer preferences during the summer season.

The June net CSI score, calculated by percentage increase minus percentage decrease in sentiment, is at +9, which has remained the same as compared to last month.

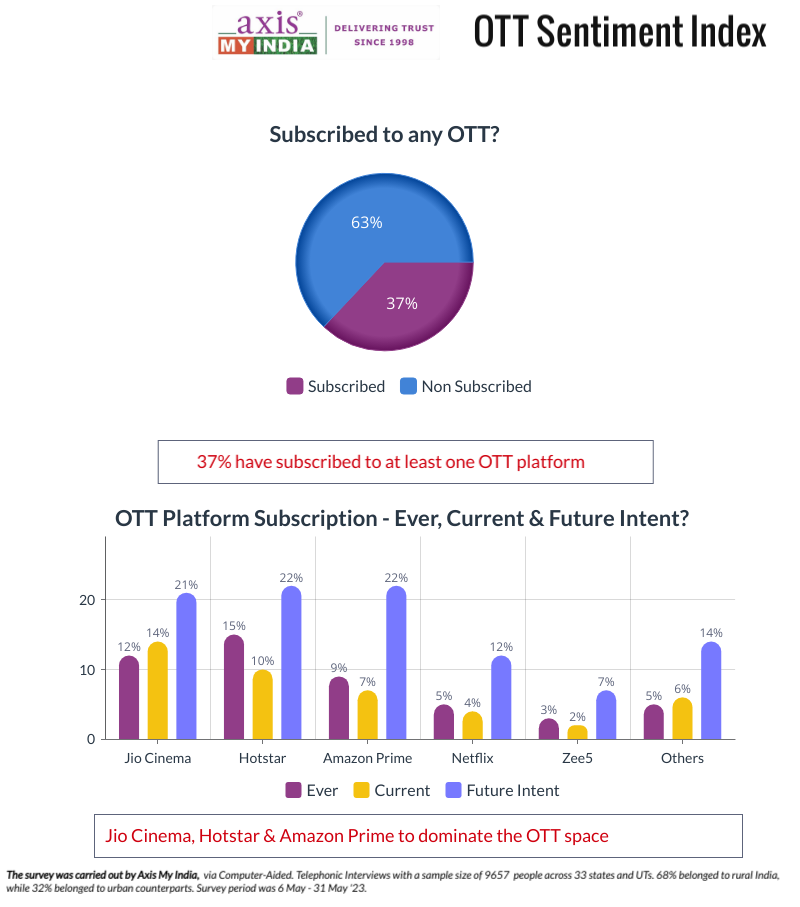

The sentiment analysis delves into five relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits, entertainment & tourism trends.

The survey was carried out via Computer-Aided Telephonic Interviews with a sample size of 9657 people across 33 states and UTs. 68% belonged to rural India, while 32% belonged to urban counterparts. In terms of regional spread, 30% belong to the Northern parts while 27% belong to the Eastern parts of India. Moreover, 30% and 13% belonged to Western and Southern parts of India respectively. 68% of the respondents were male, while 32% were female. In terms of the two majority sample groups, 30% reflect the age group 26YO to 35YO and 31% reflect the age group of 36YO to 50YO.

Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said “Understanding the shifts in consumer spending patterns is crucial in adapting to the evolving market dynamics. Household spends at an overall level has remained consistent, signifying the stability of the Indian economy. Additionally, the slight rise in essential spends for rural consumers underscores the importance of meeting basic needs by the segment and the sustained demand for non-essential and discretionary products highlights the aspirational mindset of the 26-35 age group. The insights from our survey shed light on the cautious approach towards summer season categories, with a significant majority opting to delay their purchase. These shifts in consumer behavior reflect evolving aspirations, changing priorities, and the need for businesses to adapt and cater to their evolving needs.”