68% of youth want financial stability before tying the knot, says a new IndiaLends-Betterhalf survey.

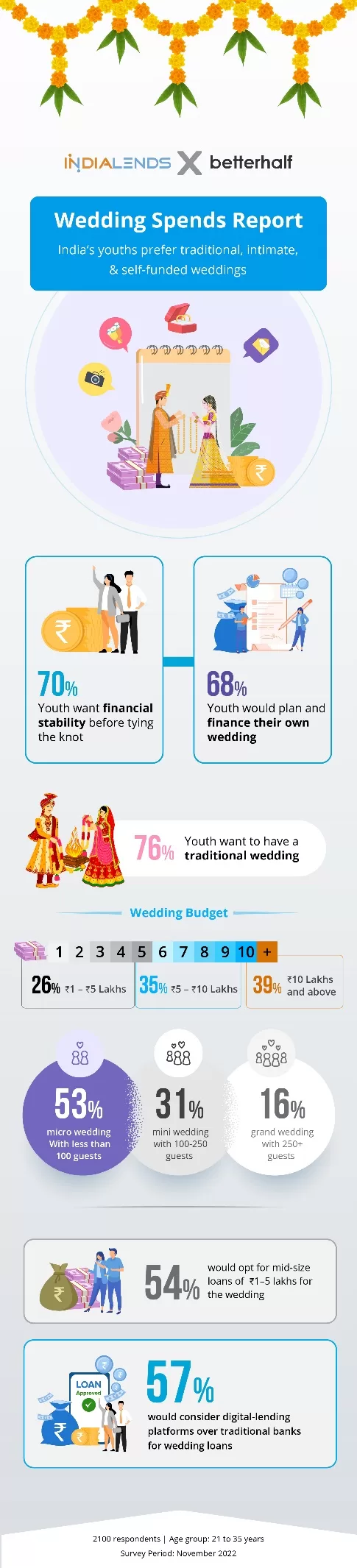

In findings from a recent nationwide survey on wedding spending, 68% of the youth reported that financial stability was a top priority when it came to marriage and achieving other personal goals. The survey also revealed that self-funded weddings were becoming the next big trend, with over 70% of Millennials and Gen Z saying they would plan and finance their own wedding.

The survey was conducted jointly by IndiaLends, an online marketplace for loans and credit cards, and Betterhalf, an AI-based matrimonial website, in 24 Tier 1 and Tier 2 cities across the country. Over 2100 respondents participated in the post-pandemic wedding survey belonging to the 21-35 age group, comprising 93% salaried and 5% self-employed.

Interestingly, the results from the survey show how Millennials and Gen Z from both the salaried and non-salaried groups are shifting towards wedding financing options such as wedding loans. Some 54% of the respondents said they would opt for mid-size loans of Rs 1–5 lakh; about 40% of the youth are willing to invest up to Rs 10 lakh on wedding and related expenses; and 35% don’t mind spending Rs 5–10 lakh. Significantly, 57% of the participants said they would consider digital-lending platforms over traditional banks for wedding loans.

Small-scale, intimate weddings, rather than large, fat Indian weddings, have become the preferred choice for young couples in the post-pandemic era. The reduction in the guest list to only family and close friends allows couples to focus on creating a one-of-a-kind premium experience, splurging on personalisation, fancy locations, and multiple ceremonies. To ease the financial pressure on families, the youth are taking charge of most of it but not all the expenses, depending on their savings, and also arranging additional funds from trusted lending sources. This allows them to pay for the pre- and post-wedding ceremonies, including venue and catering, photo shoot and videography, and even the honeymoon.

In the above context, the survey reveals that 53% of Millennials prefer a micro wedding with under 100 guests, followed by 31% choosing a mini wedding with 100–250 guests, and only 16% opting for a grand ceremony with 250+ guests. Theme and destination weddings are on trend, but the interesting fact that comes out of the survey is that, over 76% of the respondents from Tier 1 and Tier 2 cities want a traditional wedding.

IndiaLends Founder and CEO Gaurav Chopra said, “Tradition and culture have always been an intrinsic part of India and Indian families, as evident from our wedding-spend survey, which shows how the youth of today still want to celebrate their big day with family and close friends in traditional style with pomp and splendour, yet keeping it intimate. At the same time, it is heartening to see that a majority of the respondents in the 21–35 age bracket are focusing on financial stability before they decide to tie the knot and settle down. To me, this is a reflection of their core values, as they do not wish to impose a financial burden on their families. Going forward, financing a wedding will become an important component of online lending platforms, thus giving the youth the financial freedom to own their dream wedding.

Betterhalf co-founder & CEO Pawan Gupta said, “It was a pleasure to work with IndiaLends on our combined wedding-spending survey, which threw up many interesting facts about how the youth perceive a wedding. Any wedding ceremony, big or small, involves careful decision-making, planning, budgeting, and execution. I am glad to see that millennials are not just aware of what a wedding entails, but they are also willing to take financial responsibility for the nuptials. Our survey findings also indicate that the youth still dream of having a traditional, albeit self-funded, wedding. This will pave the way for new financial products and services tailored to wedding needs.”

IndiaLends is currently working with more than 60 RBI-approved partners, which include major PSUs and private sector banks, NBFCs, fintechs, and P2P lenders. The company also offers an open-API model for banks and NBFCs to partner with them through a plug-and-play approach. The company has more than 13 million customers, with over 85% of them being Millennials and Zillennials. The company achieved its cash breakeven in March 2022.